An explanation of the Homestead Cap

My property’s market value decreased on my homestead.

Why did my appraised value increase on my homestead?

If you own and occupy your home, you likely have a homestead exemption on your property. This exemption benefits you in two ways:

- If you have had your exemption for at least one full calendar year, it limits increases in your property’s appraised value to 10 percent per year or the current market value, whichever is less.

- It decreases the taxable value of your property by an additional amount, depending on the taxing entity. State law reduces your property’s taxable value by $100,000 for school districts. Other taxing entities, such as counties and cities, have the option to adopt similar benefits.

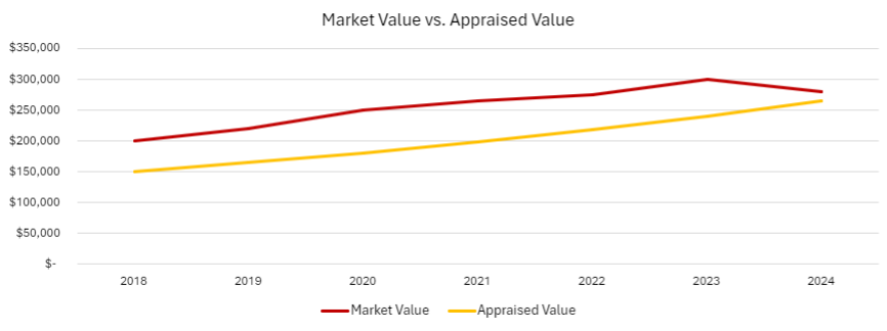

During a robust real estate market, the 10 percent cap protects a property owner from rapid increases in their property’s market value. When the real estate market slows down or dips, a property with a significant difference between its market value and appraised value may still see its taxable value increase, even if its market value decreases. The appraised value will always be either the capped amount or the current market value, whichever is less.

For example: In 2023, a property with a homestead exemption had a market value of $300,000 and an assessed value of $240,000. For 2024, if the subject’s market value has decreased to $280,000, the assessed value will continue to increase to the previous year’s assessed value ($240,000) plus 10 percent of that value ($240,000 x 10% = $24,000). The assessed value of the homestead portion of the property for 2024 will be $264,000.

This taxpayer’s value for taxes is starting at $264,000 instead of $280,000 in 2024.

Any exemptions that have been applied to your property, such as the $100,000 school district exemption mentioned above, will be deducted from the appraised value to get your taxable value. The taxable value is the value that will be given to the Tax Office so that property taxes can be calculated.

You shouldn’t panic if you see an increase in any of your property’s values. While a homestead exemption does not protect against potential changes in your property tax bill, an increase in your property’s taxable value does not mean that your property tax bill will increase. Increases in property taxes are the result of the tax rates adopted by your taxing entities. When property values are determined, taxing entities are required to calculate a no new revenue rate, or tax rate based on current values that would give them the same budget revenue as the previous year. If a taxing entity adopts a tax rate higher than the no new revenue rate, your property tax bill will increase.

Taxing entities determine their budgets and tax rates in August and September every year.

hunt.countytaxrates.com can help you understand the impact these decisions will have on future property tax bills.